I understand that building one’s assets is a long-term process that not only requires precision and time but also the aid of various tools that help to achieve your goal faster. It is crucial in the times of increasing inflation to keep a check on one’s spending and saving spree.

When a perfect balance is struck between them, you can reach your both short-term and long-term goals in the timeframe set by you. In this highly technology driven world, we want to access everything with the click of a button, isn’t it? For this, Edelweiss has successfully launched an automated expense manager. This app focuses on altering the way people handle their money in India. They understood the fact that to create long-term wealth; it is important for everyone to understand the importance of consistent long-term saving.

It is a “MUST HAVE APP” on your smartphone and let us discover the reasons behind it:

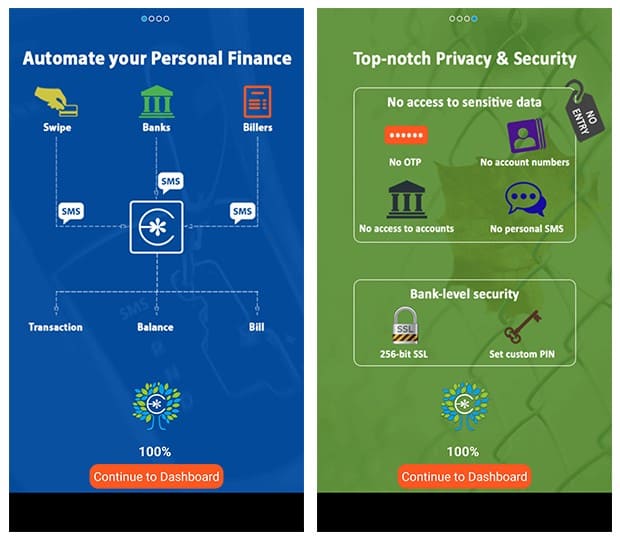

The app uses all your financial details from your SMS and provides a consolidated view of bank accounts, various bills, credit cards and spending. Edelweiss WealthPack is backed by powerful and smart algorithms that can automatically categorize all the transactions carried out by the users. This app is your ideal money manager that aids you in financial planning.

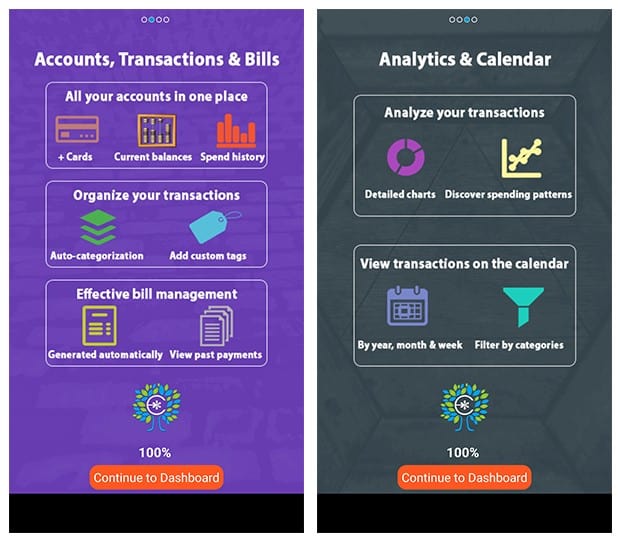

After that, a category-wise (groceries, rent, fuel, movies, food, etc.) view is shown to the users. Also, a consolidated list of due credit card bills, bill payments, and bank balances is displayed in a user-friendly interface. It is a budget tool which helps you to keep track of your personal finance. More than 50 banks and credit cards are covered by the app. Also, for the telecom bills, the Edelweiss WealthPack covers the major players like Airtel, Vodafone, and MTNL.

Most of the similar apps don’t cover few of the public sector banks, but the bank coverage of this app is quite impressive!

Fully Automated App + You Can Manually Add Transactions

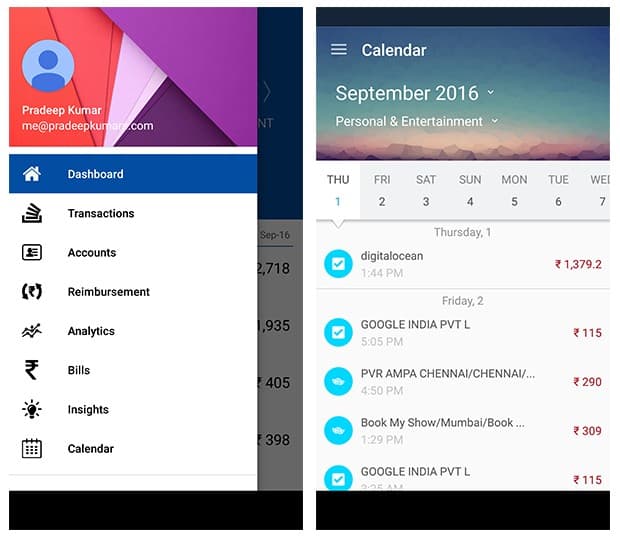

The app is your smart personal financial app and is set apart from its competitors by the analysis it offers. Without any input from the user, it knows which expenditure is an investment and which are expenses. The app works ONLY on the SMS information related to your debits and credits in your phone! The app provides myriad features like a consolidated viewing of spending, bills, and accounts. There are tools to provide the user with time-varying analysis. Thus, if you wish to compare your spending on “shopping” over a period of six months, simply move to the Analytics section and the trends can be compared easily.

Another innovative feature of the app is IOU (I Owe You). With this feature, you can easily track the payables and receivables among friends by replacing the primitive paper method.

Some Other Features

Tracks All Cash Expenses: In your cash wallet, all the ATM transactions made by you are captured and collated. You can even add them manually if you wish to. You are provided with an option at the end of the month to expense the cash or to carry it forward to the next month.

Category Expenditure: The app gives you a consolidated viewing of all monthly expenditure category wise (EMI, groceries, rent, etc. ) against the discretionary spending. This gives you an idea of your discretionary expenses – and with the help of the app, you can even manage this expenditure well.

Expenditure Via Debit Card: The app also informs you to use the reward points earned by you on credit cards. These small things if taken care of or reminded of time can help you save thousands of rupees annually. Every penny matters!

Investments Vs Expenditure: Our wealth depends on our long-term investments. With the help of WealthPack, you can even track your investments in Mutual Funds, FD’s and insurance without any manual entry.

The Insights feature gives you examples of how you are performing versus the overall users of the app. For instance, if in a month you withdrew cash from the ATM 6 times and on an average, the community did it only 2.5 times, you know you could reduce your ATM visits (more particularly if you are paying cash withdraw charges also)

The users are promised for a more detailed analysis to help them save more in the coming months. Till then Enjoy your Earning but Remember to Spend Wisely! Free Download Link for Android – Try it Today!